See also our original World Gold Reserves visualization charts.

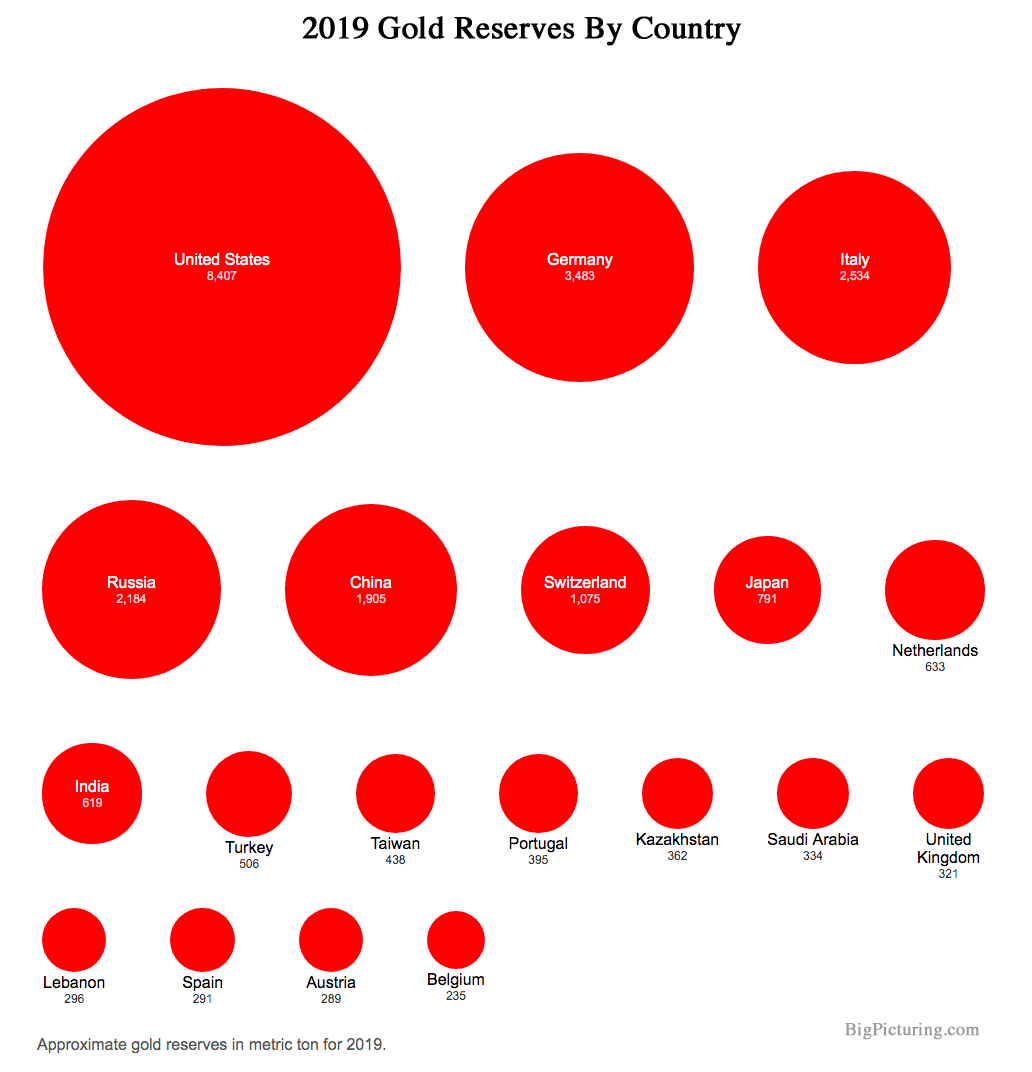

Global central banks are buying up gold in increasing quantities. China and Russia still lead the pack for central bank gold buying, but 2019 has seen other central banks enter the gold accumulation space.

The central banks ramped up gold buying to three-year highs in the first half of 2019, according to information gathered by the World Gold Council (WGC). Central banks and other official buying totaled more than 374 tons in the first six months of this year.

Despite high equity valuations globally, gold appears to be increasingly attractive to central banks. Not only is the price rising on an annual basis, but gold also may act as a counterbalance to currency instability.

The ongoing trade feud between the US and China has seen the Yuan hit new lows vis a vis the USD.

Russia is likely buying gold for political reasons, as relations with the USA continue to deteriorate. Global tensions will likely support both public and private gold buying over the medium-term, and a major financial crisis could propel gold substantially higher.

Central Banks May See Trouble Coming

It should come as no surprise that 'emerging' markets are adding the most to their gold reserves. Nations like Russia and China face stiff political pressure from the USA, which is likely one of the big reasons why their gold reserves have increased markedly over the last decade.

The actions taken by Western Central Banks in the wake of 2008's crisis probably weren't enough to push the world away from the remnants of the Bretton Woods monetary system, but the political actions undertaken by two US Presidents have done a tremendous amount to push former allies away from the USD-based banking system.

Former US President Obama punished Russia for years with sanctions, and now President Trump is taking a hard line with China. This does nothing to perpetuate the use of the USD in global trade, and many central banks may feel they are behind the curve.

China is undoubtedly the most important manufacturing nation in the world, which shines a light on the importance of their monetary preferences. The Middle Kingdom could be on the cusp of actively opposing the USD and the government that benefits directly from its use.

Russia is Buying Gold at a Furious Pace

Russia's gold holdings topped 2,200 tons this year, up from around 1,840 at the beginning of 2018. Moscow has added more than 1,400 tons to its gold reserves in the last decade, much of it bought on the open market.

It is worth remembering that China and Russia consistently rank in the top four gold producing nations, and they are also both importers of the yellow metal. Russia has been in the sights of the US government for a long time, but the last decade has been rough on the nation.

The Russian Ruble was trading at around 29 to the USD when Former President Obama first issued sanctions against Russia in 2012, and it has fallen over the course of the last seven years to 65:1 at the time of writing.

Rampant inflation was an issue in Russia during the worst days of the Ruble's devaluation on the international markets, which may be one of the reasons why Russia's central bank is so keen to accumulate gold. The price of gold in Rubles is flirting with all-time highs, which makes value buying an unlikely reason for the central bank's gold buying.

More likely, Russia's central bank sees the writing on the wall and wants to have a 'Plan B' for when the USD-based system comes under major international pressure. China is one of the other big players in this emerging narrative.

China isn't a Second Rate Power Anymore

The Middle Kingdom is still piling up gold reserves, in addition to opening up one of the only new commodity exchanges in recent history. China is the world's largest gold producing nation, but it is importing gold for both private and public buying.

July of 2019 marked the 8th straight month of gold buying by the People's Bank of China (PBoC), bringing their holdings to 1.945 tons according to official statistics. China has allowed the Yuan to depreciate past the psychologically important 7CNY:1USD level, which may signal further deprecation ahead.

In addition to buying gold at a state level, China is also holding less US Government debt. Early 2019 saw net selling of US Government debt by China, and in June of this year, Japanese entities overtook China as the largest foreign holder of US Government debt.

Bigger Problems for Washington

The days of Rome on the Potomac are clearly ending, and any nation who isn't on Washington's payroll is looking for ways to insulate themselves from political and economic uncertainty. The role of gold is becoming apparent, as China uses the yellow metal to create trust in its new commodity trading hub in Shanghai.

In a sense, the Yuan has become a gold-backed currency. In 2018 the Shanghai Futures Exchange (SFE) launched a Yuan-denominated medium-sour crude oil contract. The proceeds can be used to buy gold, which is possible to export (if the entity is sending crude into China).

China probably isn't interested in exporting its gold for Western fiat promises, but it seems to be more than willing to trade it for oil (at least in theory). An arrangement of this kind is eerily similar to the one that the US struck with the Saudis in the 1970s, which in turn cemented the USD at the center of the Western financial system.

Central Bank Gold Buying is at Three Year Highs

Russian and Chinese central banks are not alone in their appetite for increasing gold reserves

As mentioned above, the central bank and state buying has come in at more than 374 tons so far in 2019. That is the highest level in three years, and there is no sign of demand slowing down. According to a recent survey by the WGC, 54% of the central banks that responded plan to buy gold in the next 12 months.

The West versus the rest narrative may explain some of the gold buying by central banks, but there are also other factors that are in play. The global economy is sputtering, and if recent economic data is any guide, we could see even more difficult circumstances manifest in the coming months.

Turkey Needs Stable Money

Turkey could be the poster child for why central banks are adding gold reserves at a rapid clip. The Turkish Lira has fallen from around 3:1USD in late 2016 to near 5.7:1USD today. At the same time, Turkey's central bank has pumped up its gold reserves by more than 140 tons.

Like many nations, Turkey is dealing with complex economic and political realities. The nation has a violent war on its southern border, in which factions are backed by both the US and Russia. Turkey is also facing trying economic conditions, which may lead to even more political upheaval.

It is easy to understand why a nation like Turkey would opt to accumulate gold, especially as the yellow metal appears to be resuming its role as a form of global money. Turkey needs to be able to trade, regardless of whether or not the US likes the fact that it is buying state-of-the-art arms from Russia.

EM Central Banks Cut Most Since Lehman in 2019

The US Federal Reserve and ECB have been reluctant to make any big rate cuts, but that isn't the case in emerging economies. Central banks in more than 30 EM economies have cut rates this year, including regional powerhouse economies like Thailand, India, Saudi Arabia, Malaysia, and Mexico.

Easy money is great for the gold price. When the current monetary experiment started in 2009, the gold price was still in triple digits when measured in USD. Now gold is making all-time highs in a number of global currencies, the Argentine Peso, Chinese Yuan, and Turkish Lira included.

EM central banks have smaller economies, which is likely why they are making a move to ease monetary polity before the majors join the next cheap money parade to roll through the global village.

Golden Solutions for Paper Problems

A worldwide movement towards cheap, or even free money will probably drive the price of anything higher. Add to that the increasingly political nature of the Western financial system, and the stage is set for gold to resume its role as an international reserve currency.

The global financial system as we know it today began in 1971 when then-US President Nixon slammed the gold window shut on French President De Gaulle's fingertips. Now it appears that the era of Greenbacks that are as good as gold has passed, and central banks all over the world are looking for a golden anchor in a sea of fiat promises-to-pay.

Sources:

- https://www.bloomberg.com/news/articles/2019-08-01/central-banks-hunger-for-gold-pushes-demand-to-three-year-high

- https://www.gold.org/goldhub/gold-focus/2019/07/2019-central-bank-gold-reserves-survey-signals-more-buying-come

- https://www.kitco.com/news/2019-07-23/Russia-s-Total-Gold-Reserves-Top-100-Billion-As-Central-Bank-Adds-Another-600K-Ounces-In-June.html

- https://marketrealist.com/2019/07/is-china-buying-up-gold-in-a-bid-to-de-dollarize/

- https://tradingeconomics.com/russia/gold-reserves

- https://en.wikipedia.org/wiki/List_of_countries_by_gold_production

- https://www.tradingview.com/symbols/USDRUB/

- https://www.npr.org/2017/07/21/538086476/u-s-sanctions-against-russia-never-go-away-they-just-evolve

- https://markets.businessinsider.com/commodities/news/china-bought-more-gold-to-prepare-for-the-trade-war-2019-8-1028427737

- https://www.caixinglobal.com/2019-08-16/charts-of-the-day-china-unseated-as-largest-foreign-holder-of-us-debt-101451911.html

- https://news.cgtn.com/news/7959444f306b7a6333566d54/share_p.html

- https://tradingeconomics.com/turkey/gold-reserves

- https://www.tradingview.com/symbols/USDTRY/

- https://www.zerohedge.com/news/2019-09-03/emerging-market-central-banks-panic-most-rate-cuts-financial-crisis